GOLD TALKING POINTs

The price of gold attempts to retrace the decline from the beginning of March as the US 10-Year Treasury yield pulls back from a fresh yearly high (1.62%), but key market themes may keep the precious mental under pressure as the Federal Reserve appears to be in no rush to alter the path for monetary policy.

FUNDAMENTAL FORECAST FOR GOLD: BEARISH

The price of gold bounces back from a fresh weekly low ($1688) as the initial reaction to the 379K rise in US Non-Farm Payrolls (NFP) dissipates, and the recent weakness in longer-dated Treasury yields may lead to a larger rebound in the precious metal even as the Federal Open Market Committee (FOMC) maintains a dovish forward guidance.

Recent remarks from Fed Chairman Jerome Powell suggests the FOMC will retain the current course for monetary policy as the committee expects to “see inflation move up through base effects,” with the central bank head going onto say that the re-opening of the economy “could create some upward pressure on prices” while speaking at a virtual event hosted by the Wall Street Journal.

However, Chairman Powell argues that “the real question is how large those effects will be and whether they will be more sustained or more transitory,” with the comments largely aligning with the dovish rhetoric from Governor Lael Brainard as the central bank head warns that “it’s not at all likely that we’d reach maximum employment this year.”

As a result, the Fed may continue to endorse a wait-and-see approach at its next interest rate decision on March 17 as Chairman Powell insists that the forward guidance is “outcome-based,” and it seems as though the FOMC will rely on its current tools to achieve its policy targets as the central bank head reiterates that the “current stance is appropriate.”

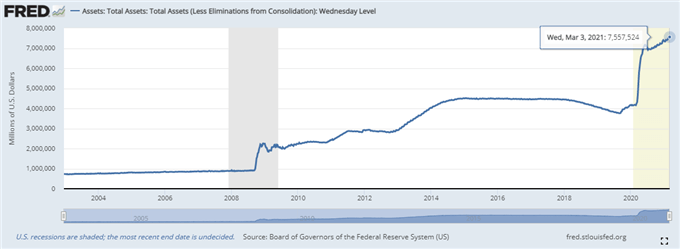

In turn, key market themes may continue to influence gold prices even though the Fed’s balance sheet narrows from the record high of $7.590 trillion to $7.558 trillion in the week of March 3 as the FOMC stays on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.”

With that said, the broader recovery in longer-dated US Treasury yields may keep gold prices under pressure as ballooning central bank balance sheets no longer provide a backstop for bullion, with the recent breakdown in the price of gold now testing the first major hurdle at downtrend support early in the month of March.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

تعليقات

إرسال تعليق